In today’s fast-paced Fintech world, financial institutions face a growing number of challenges, including increased scams and frauds, especially in credit evaluation and lending. Traditional credit scoring models often fall short in identifying high-risk borrowers, leaving lenders vulnerable to default risks and fraudulent applications. This is where predictive analytics, powered by artificial intelligence (AI), comes into play. By analyzing vast datasets and detecting patterns that traditional methods miss, predictive analytics offers a more secure, accurate way to assess borrower risk and mitigate fraud.

As an ITO company, we provide solutions that integrate these advanced technologies, helping financial institutions enhance risk management and protect themselves against rising fraud threats.

1. Understanding Predictive Analytics in Fintech

Understanding predictive analytics in fintech is essential for grasping how financial institutions assess credit risk and make informed lending decisions. Before diving into the subject, we must understand the initial development of credit evaluation activities to understand further context.

a. Historical Perspective

In the early stages of credit risk evaluation, financial institutions primarily focused on assessing a borrower’s creditworthiness through traditional metrics. Lenders would analyze factors to gauge the likelihood of legitimate such as financial history, credit scores, income stability and existing debt levels. However, this process often over-relied heavily on historical data and personal interviews, where lenders would evaluate the borrower’s character and financial behavior. The objective was to develop a comprehensive understanding of the borrower’s ability and willingness to repay loans. But this approach had various drawbacks at that point of time that hindered high risks such as:

- Lack of accuracy and transparency in forecasting

- Subjective judgement from evaluator

- Time-consuming processes

- Out-dated data

But, thanks to the advent of big data and machine learning in the 21st century, credit risk evaluation further revolutionized. Financial institutions began leveraging vast datasets and complex algorithms to analyze patterns and behaviors that traditional models could not capture. Today, the integration of alternative data sources—such as transaction histories and behavioral analytics—continues to enhance the precision and effectiveness of credit risk assessments.

b. Today Definition and Impact

Subsequently, predictive analytics is a branch of advanced analytics that employs statistical techniques, machine learning algorithms, and data mining to forecast future outcomes based on historical and current data.

From an IT perspective, predictive analytics involves the integration of various data sources and sophisticated computational methods to analyze patterns and trends within large datasets. This process typically includes data collection, cleaning, modeling, and validation, enabling organizations to derive actionable insights from complex information. The technological advancements in computing power and data storage have made it possible for businesses to analyze vast amounts of data more efficiently than ever before.

From a Fintech perspective, predictive analytics plays a crucial role in assessing credit risk and enhancing decision-making processes related to lending. It enables financial institutions to identify potential risks associated with borrowers by analyzing diverse data points beyond traditional credit scores—such as transaction histories, social media activity, and even economic indicators. By leveraging predictive models, fintech companies can make informed decisions about loan approvals, interest rates, and risk management strategies while improving customer experiences through tailored offerings.

c. Key Roles in Fintech Field

Additionally, the fundamental benefits of predictive analytics in fintech are multifaceted and crucial for effective credit risk management:

- Enhance accuracy of credit assessment

- Facilitation of real-time decision-making

- Continuous monitoring and improvement

- Personalized customer experiences

- Informed risk management strategies

2. AI’s Impact on Risk Management

a. Mechanisms of AI in Predictive Analytics

AI in predictive analytics operates through several core mechanisms that allow it to process data, learn from it, and make predictions efficiently:

-

Machine Learning (ML):

Machine learning is the main engine behind AI in predictive analytics. ML models learn from historical data and continuously improve over time. For instance, when predicting loan defaults, ML algorithms analyze past data like borrower credit scores and repayment history to predict whether a new borrower is likely to default. These models get more accurate as they process more data.

-

Natural Language Processing (NLP):

NLP helps AI systems understand and analyze human language. This allows AI to gather insights from unstructured data sources, such as social media posts or customer reviews, which can offer clues about a borrower’s financial situation or changes in behavior that could indicate a higher risk of default.

-

Neural Networks:

Neural networks are AI models inspired by the human brain that excel at recognizing complex patterns. When applied to financial data, neural networks can analyze multiple factors—like income, spending habits, and credit history—simultaneously to predict a borrower’s risk of default.

-

Decision Trees and Random Forests:

These AI models make decisions based on different criteria. For example, a decision tree might split data into branches based on income levels or credit scores to predict whether someone is likely to default. Random forests combine multiple decision trees for even more accurate predictions.

Case Studies: AI in Predictive Analytics for Risk Management

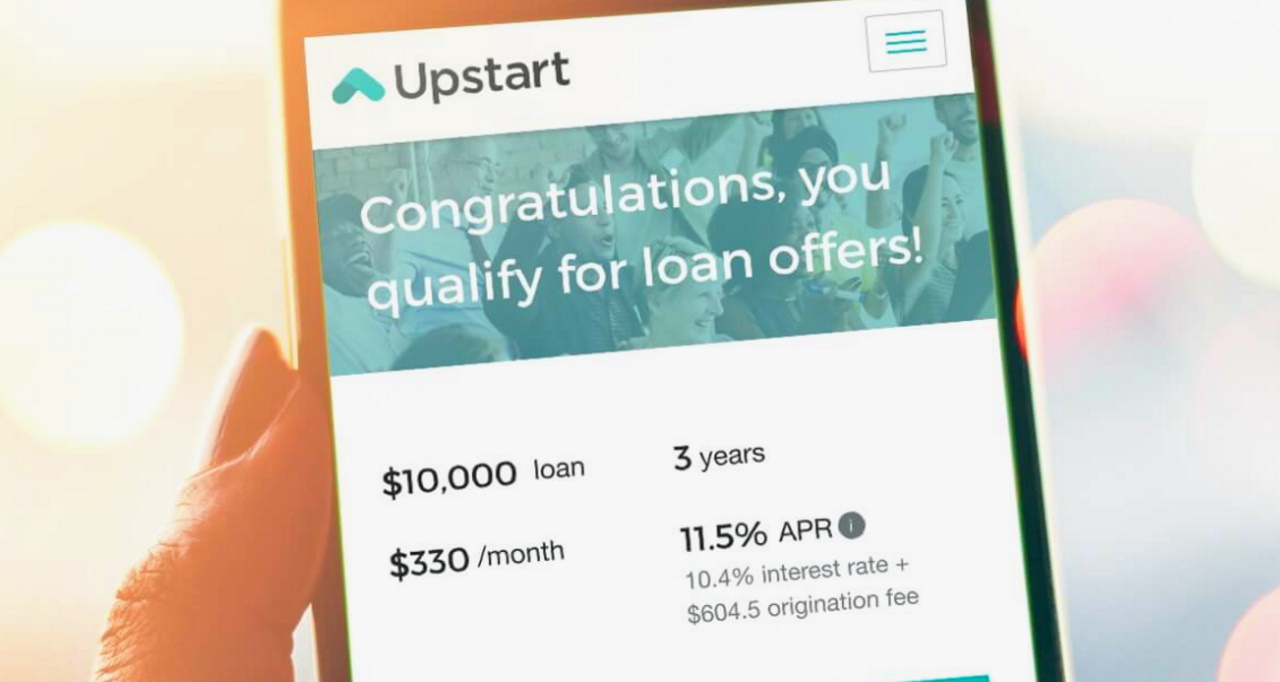

- Upstart

Upstart, a Fintech company, uses AI to evaluate loan applicants more comprehensively than traditional methods. Rather than relying only on credit scores, Upstart’s AI models consider additional factors like education, employment history, and even the field of study. By analyzing these data points, Upstart’s AI system can more accurately predict which applicants are likely to repay their loans. This has resulted in a 75% improvement in default prediction accuracy compared to traditional methods, allowing Upstart to offer lower interest rates while maintaining low default rates.

- Zest AI

Figure 2: ZestAI

Zest AI (formerly ZestFinance) uses machine learning to analyze thousands of variables about each borrower, including alternative data like rent payments and utility bills. This comprehensive approach allows Zest AI to make more inclusive lending decisions while reducing risk. One of their clients, a large U.S. auto lender, used Zest AI’s models to reduce default rates by 15% and increase loan approvals by 30%, demonstrating how AI can improve both risk management and business outcomes.

- Implementing AI Predictive Analytics

Implementing AI-powered predictive analytics in Fintech requires a strategic approach. Financial institutions must first ensure that they have the necessary infrastructure and data management capabilities in place to support these advanced models. Here’s a step-by-step guide for financial managers and institutions looking to implement AI predictive analytics effectively:

- Collecting data: The first step is gathering large datasets, including both traditional and non-traditional data sources. This data must be properly structured, cleaned, and stored in a secure environment that allows for easy access and processing.

- Developing the model: Depending on the specific goals, financial institutions can choose from a variety of AI models, such as decision trees, neural networks, or support vector machines. These models should be trained on historical data and continuously updated to reflect new trends.

- Integrating into the system: AI predictive analytics must be integrated with existing systems, such as loan origination systems, credit scoring platforms, and risk management software, to ensure a seamless flow of information and real-time decision-making.

- Monitoring: AI models are dynamic and require ongoing monitoring to ensure their accuracy and relevance. Financial institutions should regularly evaluate the performance of their predictive models and make adjustments as needed to maintain high levels of accuracy.

- Security: Ensuring that predictive analytics solutions comply with regulatory standards is critical. AI implementations must adhere to data privacy laws, such as GDPR, and include robust security measures to protect sensitive financial information.

- Advice for Managers

Financial managers looking to implement AI-driven predictive analytics should start by ensuring their organization has a solid data infrastructure. This includes collecting and managing high-quality, comprehensive data, both traditional and non-traditional, to feed AI models. Investing in the right talent, such as data scientists and IT professionals, is essential for developing and maintaining these models. If expertise is lacking, partnering with Fintech or ITO firms specializing in AI can be highly beneficial.

Begin with small, focused projects, like using AI to assess loan default risks, and scale gradually as success is demonstrated. Transparency and regulatory compliance are critical, especially in how AI-driven decisions are communicated to customers. It’s also important to continuously monitor and update AI models to ensure they remain accurate and relevant over time. By taking a strategic and phased approach, financial managers can reduce risk and enhance decision-making effectively.

- What’s Next?

As AI and predictive analytics continue to evolve, the future of risk management in Fintech looks promising. The next wave of innovation will likely include even more sophisticated machine learning models, deeper integration of alternative data, and stronger regulatory frameworks. Financial institutions that stay ahead of these trends will be better positioned to manage risks, enhance customer experiences, and remain competitive.

For financial managers, now is the ideal time to embrace these advancements by partnering with an Information Technology Outsourcing (ITO) company like SmartDev. We specialize in implementing cutting-edge AI and predictive analytics solutions tailored to your business needs. By working with an expert partner, you can ensure seamless integration of these technologies, reduce implementation risks, and unlock new opportunities for growth and efficiency.